Securing your financial future requires a solid plan that empowers you to manage your cash flow effectively. A well-crafted budget serves as the bedrock of this strategy, providing a clear framework for allocating your resources and reaching your financial goals. By diligently tracking your income and expenses, identifying areas for savings, and setting realistic spending limits, you can pave the way for long-term financial stability.

- Start by meticulously tracking your income and expenses for a month or two. This will provide a baseline understanding of your current patterns.

- Classify your expenses into essential and non-essential segments to identify areas where you can potentially trim spending.

- Define realistic financial goals that align with your long-term plan. This will provide motivation for your budgeting efforts.

- Program regular savings contributions to ensure you consistently grow your financial nest egg.

- Reassess your budget regularly and make necessary tweaks based on changes in your income, expenses, or goals.

Remember, mastering your money is an ongoing process. By consistently applying these essential budgeting tips, you can pave the way for a secure and prosperous financial future.

Unlock Financial Freedom: Smart Budgeting Strategies for a Secure Future

Achieving financial freedom reaches a dream for many, but it's a goal that can be attained through disciplined budgeting practices. By taking control of your finances and implementing effective budgeting strategies, you can pave the way to a more stable future. A well-crafted budget allows you to track your income and expenses, identifying areas where reductions can be made. This not only helps you minimize unnecessary spending but also facilitates you get more info to designate funds towards your retirement goals.

- Create a thorough budget that reflects your income and expenses.

- Monitor your spending diligently to identify patterns in your financial behavior.

- Define realistic savings goals for work towards them consistently.

- Explore different investment options to expand your wealth over time.

- Seek professional financial advice if needed to create a personalized plan.

Remember, building a strong financial foundation is a journey. By embracing smart budgeting strategies and staying committed to your goals, you can unlock the door to financial freedom and guarantee a brighter future.

Forge Wealth, Not Debt: Proven Budgeting Techniques for Lasting Prosperity

Achieving lasting financial prosperity isn't a matter of luck; it's about developing sound expenditure habits. This means transforming your mindset from one of instant gratification to long-term wealth. By embracing proven budgeting strategies, you can triumph over debt and establish a solid foundation for future security.

- Adopt the 50/30/20 Rule: Allocate a proportion of your earnings to necessities, thirty to wants, and one-fourth to investments.

- Monitor Your Expenses: Employ a budgeting app, spreadsheet, or classic notebook to gain a clear view of where your money is spent.

- Automate Your Savings: Set up automatic payments from your checking account to your savings or investment accounts.

Remember, building wealth is a journey that requires discipline and a strategic viewpoint. By implementing these proven budgeting techniques, you can equip yourself to attain lasting financial prosperity.

Securing Your Path to Financial Independence: A Guide to Effective Budgeting

Embarking on the journey for financial independence can seem daunting, but with a solid budgeting foundation, you can pave the way with a more secure future. Effective budgeting involves strategically tracking your income and expenses, identifying areas where you can reduce spending, and assigning funds to your financial goals. By implementing a personalized budget that aligns with your values and needs, you can gain control over your finances and reach steady progress in the direction of your financial independence dreams.

- Initiate by tracking your income and expenses thoroughly.

- Categorize your expenses into fundamental and optional categories.

- Set realistic spending limits for each category.

- Consider ways to reduce your costs.

- Analyze your budget periodically and make changes as needed.

Achieving Your Financial Goals Step by Step

Embarking on the journey to financial success doesn't have to be a daunting task. By implementing a well-structured budget, you can pave the way for achieving your dreams. A robust budgeting blueprint empowers you to analyze your income and expenses, providing invaluable insights into your spending habits. With this knowledge, you can make informed choices to allocate your funds effectively, prioritizing essential needs while also indulging in occasional treats.

- Craft a personalized budget that mirrors your unique financial situation and goals.

- Utilize budgeting techniques that resonate with your lifestyle, such as the 50/30/20 rule or the envelope system.

- Regularly review and modify your budget to ensure it remains aligned with your evolving needs and priorities.

Remember, budgeting is a dynamic process that requires ongoing attention and adaptability. By embracing these principles, you can confidently navigate the path to financial well-being and unlock a future filled with possibilities.

Take Control of Your Money: Powerful Tips for Sustainable Financial Growth

Achieve your financial goals and build lasting wealth with these effective budgeting tips. First, develop a comprehensive budget that tracks your income and expenses. Identify areas where you can minimize spending without sacrificing your quality of life.

Next, define specific financial goals, whether it's saving for a down payment on a house, paying off loans, or investing for retirement. Program regular transfers to your savings and investment accounts to ensure consistent growth. Regularly evaluate your budget and make adjustments as needed to remain consistent.

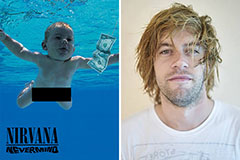

Spencer Elden Then & Now!

Spencer Elden Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!